From Friday, July 1, 40,000 new places have become available under the Federal Government’s Home Guarantee Scheme to help Australians buy their home.

The Home Guarantee Scheme is made up of the First Home Guarantee - previously known as the First Home Loan Deposit Scheme - and the Family Home Guarantee.

The aim of this scheme is to allow first home buyers to buy a property with a deposit as small as 5 per cent, and eligible single parents with a deposit as small as 2 per cent. The Government then guarantees the remaining amount - 15 and 18 per cent of the property price, respectively - avoiding the need for Lenders Mortgage Insurance.

The number of places available for the First Home Guarantee has been increased to 35,000 per financial year, while the Family Home Guarantee will have an annual allocation of 5000 places, starting July 1 2022 until June 30 2025.

First Home Guarantee

The First Home Guarantee was created as an Australian Government initiative to support eligible first home buyers to purchase a home sooner.

To be eligible for this grant, applicants must be:

- Applying as an individual or couple (married / de facto)

- An Australian citizen(s) at the time they enter the loan

- At least 18 years of age

- Earning up to $125,000 for individuals or $200,000 for couples, as shown on the Notice of Assessment (issued by the Australian Taxation Office)

- Intending to be owner-occupiers of the purchased property

- First home buyers who have not previously owned, or had an interest in, a property in Australia

The Family Home Guarantee

The Family Home Guarantee has been developed to specifically help single parents buy a family home.

You can use this scheme to either build a new home, or buy an existing one. Both first home owners and previous home owners can apply - however, you can’t use it to buy an investment property or if you currently own a home.

To be eligible for the Family Home Guarantee you must:

- Be an Australia Citizen aged 18 years or over

- Be a single parent with at least one dependant living with you

- Have earned $125,000 or less last financial year The single parent applying for this grant must also be the only name listed on the loan and the certificate of title.

New Price Caps

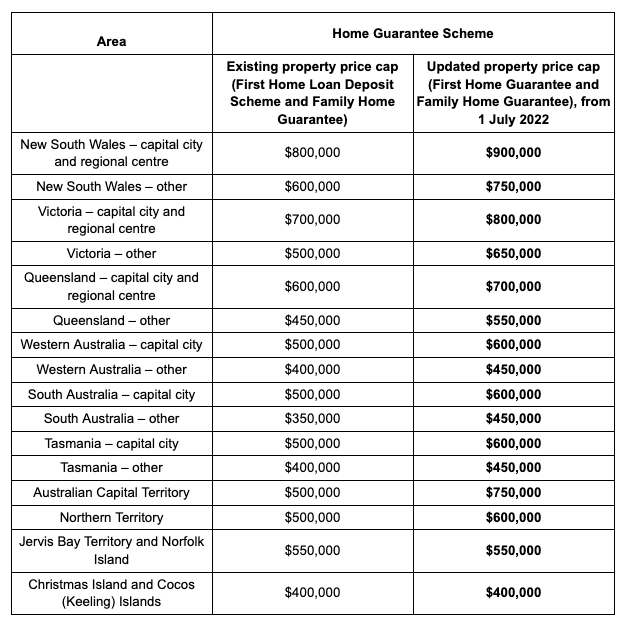

High house prices throughout our cities and regions has made it extremely difficult for first home buyers and single parents to enter the housing market. By increasing the highest price a person can pay for a home within the Home Owners Guarantee, the Government hopes to make this easier.

See below the new price caps for each state and territory.

Take Advantage of Slowing Markets

This time round, home buyers not only have more places available where they can enter the market thanks to lower deposit requirements, but higher price caps means more locations across the country have been unlocked. This, compounded with slowing markets, gives home buyers the perfect incentive to buy.

Get in touch

If you are thinking about taking advantage of the Home Owners Guarantee and would like to know more, get in touch today. Our home loans team are extremely experienced and would love to help you along your path to home ownership.